Back in 2017 Chicago was the first major U.S. city to pass a tax on ride-hail to fund transit infrastructure, paving the way for peer cities to follow suit. Today we pioneered another initiative to help mitigate the harmful effects of Uber and Lyft on urban transportation, with a new fee structure designed to convert more solo trips to shared ones and boost CTA ridership, which is also likely to set a precedent for other towns. The City Council passed Mayor Lori Lightfoot’s $11.65 billion budget, including the new ride-hail tax, by a 39 to 11 margin, with several aldermen referring to it as a sensible and progressive measure.

Currently Chicago has a flat total tax of $0.72 per Uber or Lyft trip, whether it’s a blue-collar worker taking an Uber Pool ride home from their local ‘L’ station at 3 a.m., or a CEO taking a traffic-clogging private trip many miles downtown during the morning rush. Under the new system, the tax on a shared ride in the neighborhoods drops to $0.65, while the fee on a private one goes up to $1.25. Downtown shared trips during peak hours (weekdays from 6 a.m. to 10 p.m.) will be taxed at $1.25, while private downtown peak-hour trips will be assigned a full $3 fee.

The new structure should encourage more people to take advantage of already-cheaper Uber Pool and Lyft Line rates instead of taking private trips by providing a $0.60 tax savings in the neighborhoods. It should also make many people think twice about using ride-hail downtown, where there are plentiful transit options. That should ease congestion, speed up bus service, boost CTA ridership, and help prevent service cuts and fare hikes due to ride-hail cannibalizing transit use. The new tax is projected to raise $40 million a year, with most of that going to plug Chicago’s $838 million budget hole, but $2 million earmarked for projects to improve bus service, such as dedicated lanes.

Needless to say, the ride-hail companies, particularly Uber, fought Lightfoot’s initiative tooth-and-nail. Their main strategy was to argue that the new fees would disproportionately impact poor and working people on the South and West sides, with Uber enlisting 35 Black ministers to bolster their claim that the tax would hurt African Americans. (Last spring all 35 clergy members helped the corporation make the same argument about the city’s deal with Lyft to expand the Divvy bike-share system citywide, part of a propaganda campaign that also involved Uber buying sympathetic news coverage in local Black media.) For example, Reverend William Hall claimed that the mayor’s plan would “balance the budget on the backs of low-income communities.”

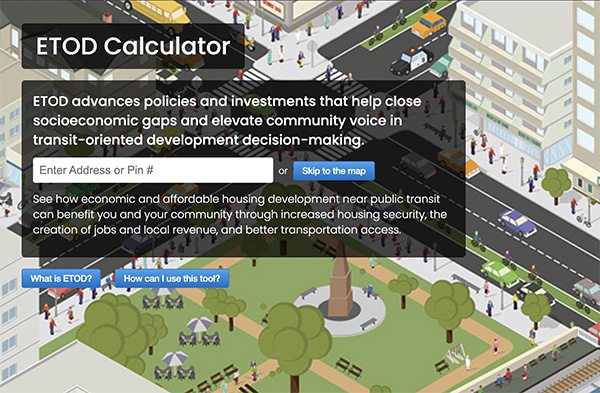

However, numbers from a recent city of Chicago report on ride-hail data show that won’t be the case. As it stands, most trips hailed on the South and West sides are shared, non-downtown trips, which will be cheaper under the new structure, while 70 percent of rides requested downtown and on the more affluent North Side are private. Therefore, as you can see from the map by the Center for Neighborhood Technology, the vast amount of the new revenue will come from higher-income communities. Meanwhile, lower-income Chicagoans, who are more likely to depend on transit, particularly buses, will disproportionately benefit from the enhanced CTA service.

Strengthening Transit Through Community Partnerships

Strengthening Transit Through Community Partnerships